I keep hearing about trailing stops but I am not clear on their function or when to use them.

Some traders discussed them in chat, but the explanations left me confused. Is it really necessary to learn about them as I am still learning the basics?

I am also curious if they are effective on mobile or if a desktop is needed for proper setup.

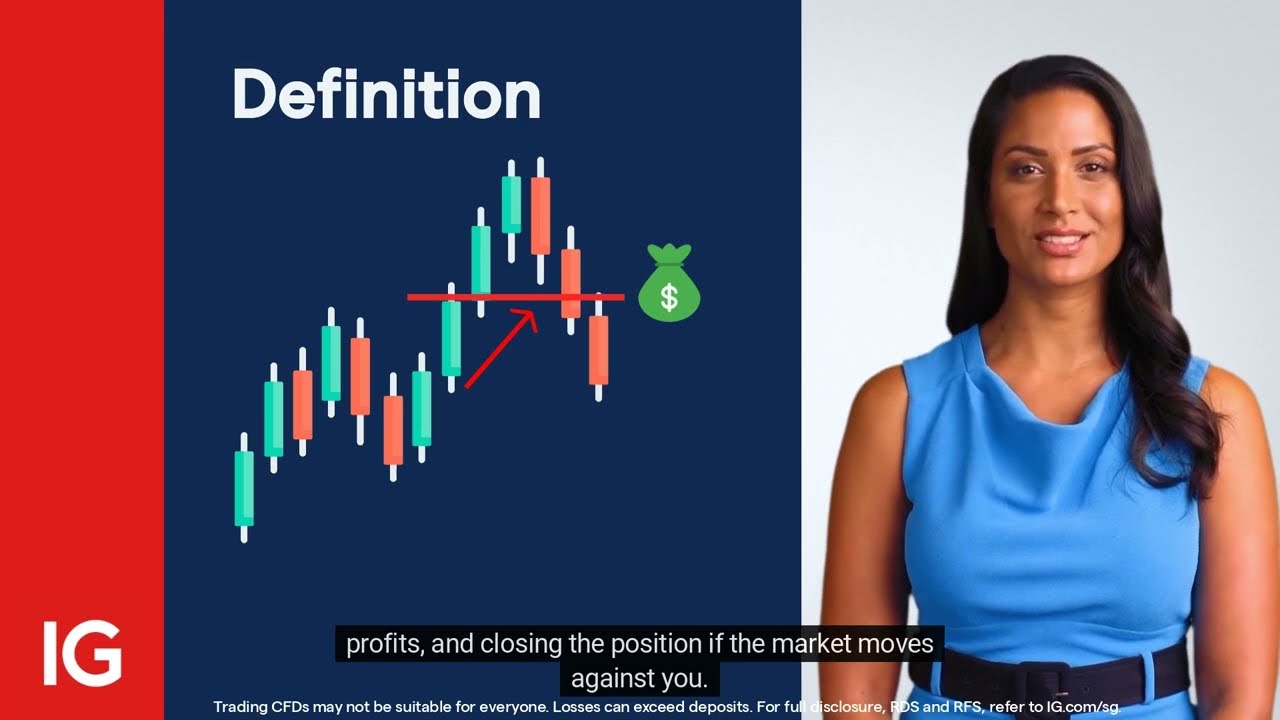

Simple concept that’ll save you from giving back all your profits. Trailing stops follow your position up but stay put when price drops. It’s like a moving floor that only goes higher.

Use them when you’re already profitable and want to let winners run. Set the distance based on how much the asset normally moves - too tight and you’ll get stopped out on tiny pullbacks, too loose and you’ll give back too much.

Mobile works fine for setting them up. Just make sure your broker actually executes them properly when things get volatile.

Use 3-5 pips for trailing stops. Adjust based on daily volatility.

Trailing stop moves up with price but stays put when price drops.

Use it when:

• You’re in profit

• A strong trend is running

• The market isn’t too choppy

Set it 2-3 times ATR away. Works fine on mobile with most brokers.

Trailing stops adjust your stop loss as the price moves favorably. It acts like a safety net that follows but won’t revert if the market shifts against you.

Most brokers support these features on mobile, so no desktop is necessary. Timing is crucial.

They work well when profits are locked in, allowing potential gain while minimizing loss. Avoid them in choppy markets as they may trigger too soon.

Lost $200 on Apple stock last month because I didn’t use a trailing stop when it was up 15%.

Trailing stops lock in profits by moving your exit point higher as price climbs. When the trend reverses, you get stopped out but keep most gains.

Works fine on mobile. I set mine 10-15 points behind on most trades now.