Been hearing about protective puts in some trading groups but not sure what they actually are.

Saw someone mention using them to protect their stock positions but I don’t really understand how it works. Is it like insurance for your trades?

Anyone here use protective puts regularly?

Bought puts on my AMD position last month, saved me $800 when it dropped.

Protective puts are basically insurance - you pay upfront to cap your losses. When I’m holding stocks through sketchy times, I’ll buy puts about 10-15% below the current price. Don’t go crazy with premiums though, they’ll kill your gains.

The beauty is you keep all the upside but limit downside. Just know the put expires worthless if the stock doesn’t tank, so work that cost into your position size.

Most people skip this thinking it’s too pricey, but eating a 30-40% loss hurts way more than paying a few points in premium.

Puts typically cost 1-3% of the stock’s value. The strike price determines your maximum loss. Time decay reduces value if the stock price remains unchanged.

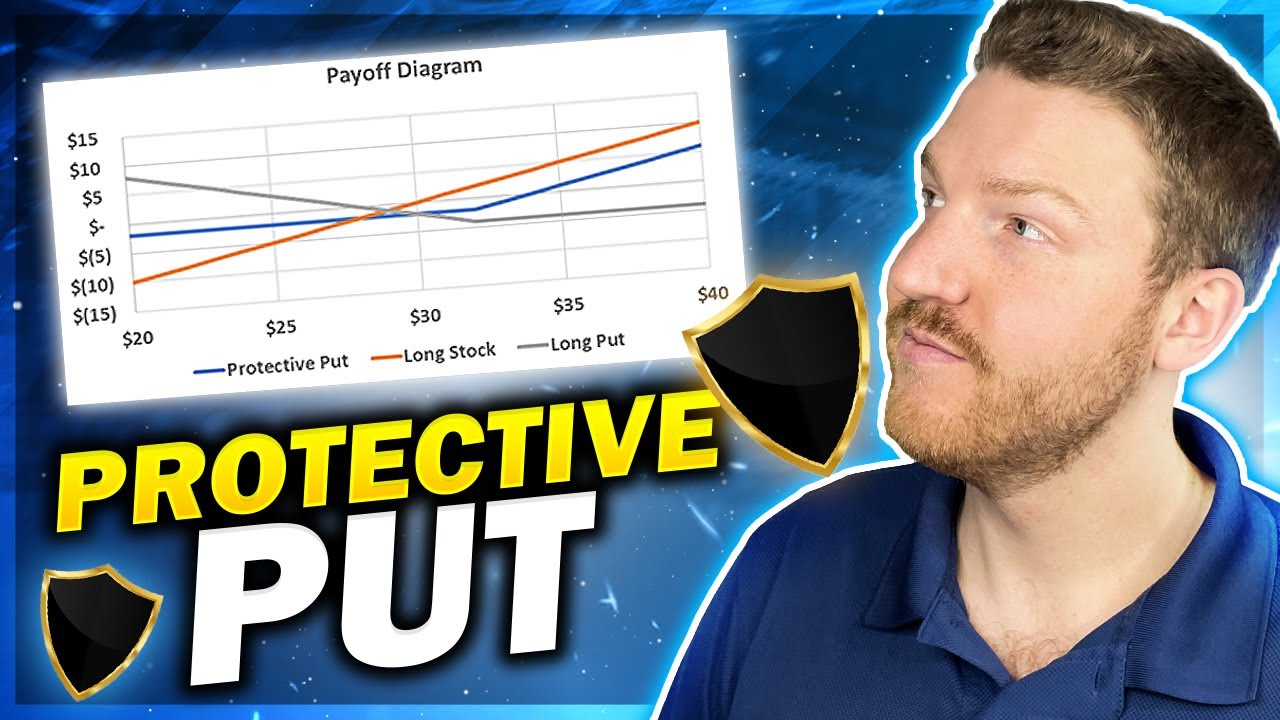

Think of a protective put as a safety net for stocks in your portfolio. You can buy a put option to lock in a selling price, which protects against significant losses.

For example, if you have 100 shares priced at $50, purchasing a put option with a $45 strike price means your potential loss is $5 per share, no matter how low the stock goes.

Keep in mind, though, that this protection comes at a cost that can affect profits when prices are rising.

I lost 40% on Tesla in 2022, which led me to protective puts.

You buy a put option when you own the stock. If the stock falls, the put gains value and limits your losses.

It’s like having insurance for your investment. You pay the premium but it eases the stress during downtrends.