Been looking at some options plays lately and trying to understand theta better.

What theta range do you usually look for when picking strategies? I know it depends on the strategy but wondering what works for most people.

Still learning this stuff so want to make sure I’m not picking terrible positions.

Theta largely hinges on your strategy and timeline. Decent positions often have theta between -0.05 and -0.15 for longer plays.

In shorter-term trades, higher theta decay can eat profits quickly. Ensure your trade moves in your favor before theta takes a toll.

As a beginner, it’s wise to steer clear of very high theta positions unless you’re certain about timing.

Lost $800 on my first options trade because I ignored theta completely. The stock moved my way but time decay killed me.

Now when I sell premium I target theta above 0.20. When buying I keep it under -0.10 and never hold past 30 days to expiration.

That harsh lesson taught me theta is more important than direction sometimes.

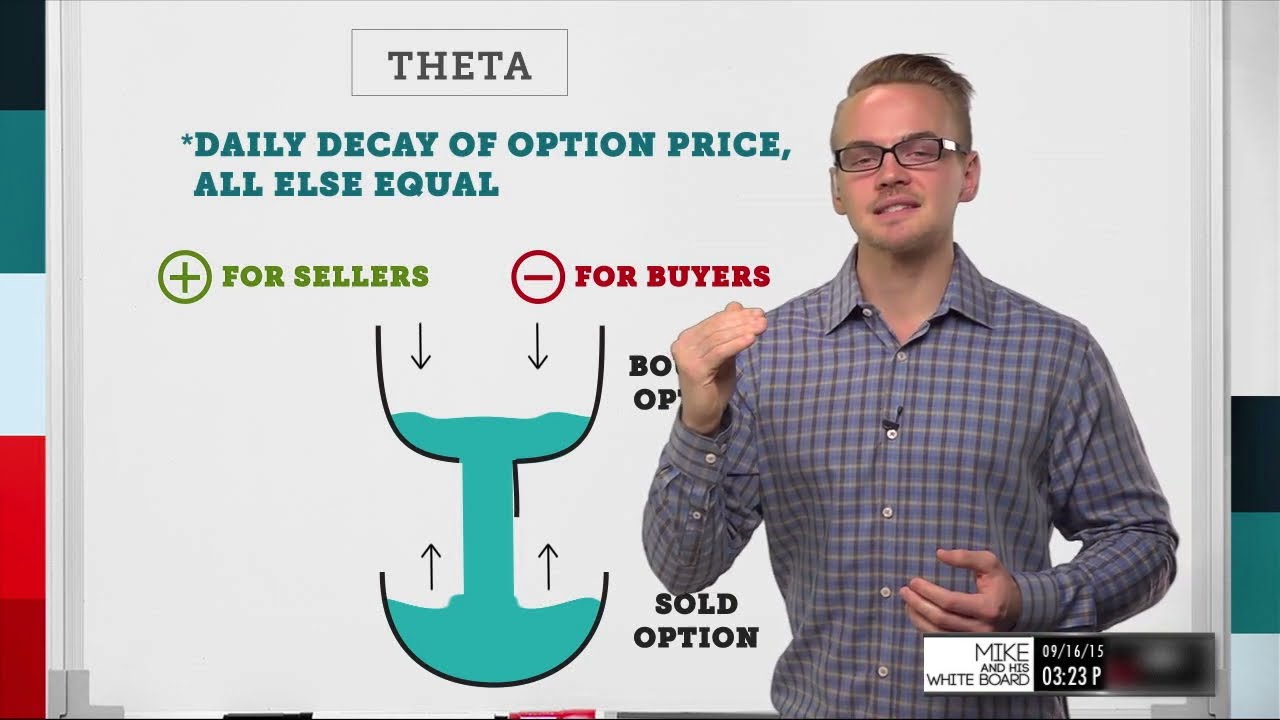

Sell options with theta above +0.10. Buy options with theta below -0.05 only if strong directional bias exists. Theta works for sellers, against buyers.

Theta really depends on what side you’re on. When selling options, I want to see at least 0.15 daily decay working in my favor. Buying options, I avoid anything over -0.20 unless I’m expecting a big move within days. Most traders get burned because they don’t realize theta accelerates closer to expiration. I stick to 30-45 days out when selling and never buy options with less than 2 weeks remaining.

The key is matching theta to your timeline. Quick scalps can handle higher theta, but swing trades need more breathing room before decay kicks in.

For my credit spreads, I find that around 0.30 theta is effective.