Been trading options for a while now but still struggle with calculating intrinsic value fast enough during live trading.

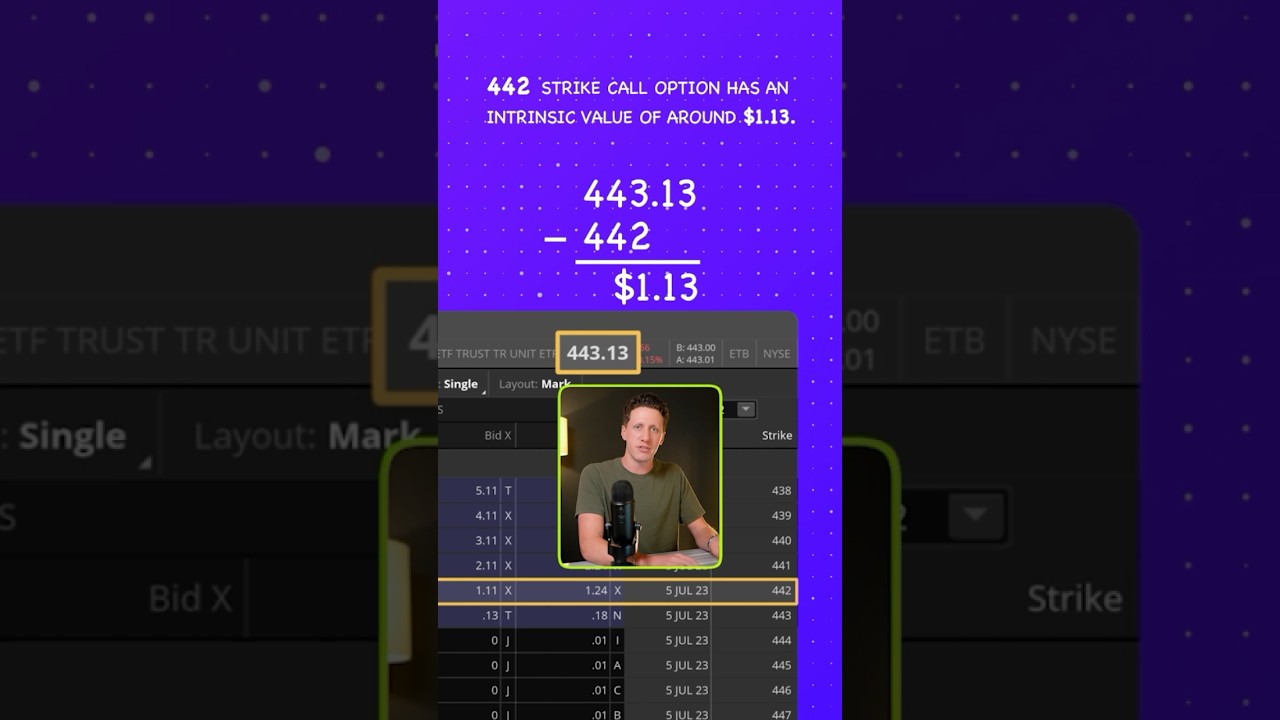

Usually I just subtract strike price from current price for calls but wondering if there’s a quicker method you guys use.

Sometimes I miss good opportunities because I take too long doing the math.

Most trading apps show intrinsic value automatically in the options chain if you look closely. That saves you from doing manual calculations during fast moves.

When I need to calculate quickly, I just focus on whether the option is in the money first. If the call strike is below current price, then it has intrinsic value worth the difference.

Back when I started options trading, I kept a simple cheat sheet taped to my monitor with the formulas.

For calls it’s just current price minus strike price, but only if that number is positive. If it’s negative, intrinsic value is zero.

I lost money on a Tesla call once because I confused intrinsic value with time value during a volatile session.

Use mental shortcuts. Round prices to nearest dollar. For calls, intrinsic value equals stock price minus strike if positive.

Your calculation method is correct, but speed comes from preparation. Before market open, I mark key strike levels on my charts so I can see intrinsic value at a glance without doing math during trades.

Set alerts at round numbers where options go in-the-money. This way you focus on trading instead of calculating. After 8 years, I learned that missing trades due to slow math costs more than using simple visual references.

The real trick is knowing which strikes matter before volatility hits. Most profitable option trades happen when you already know your entry and exit points.

To find intrinsic value, just use the formula max(current price - strike, 0) for calls. Becomes quick with practice.